As a way of increasing their employee’s welfare, most employers put in place what is called group employee benefits as a condition of employment. Some of the group employee benefits which an employee might take up are medical cover, disability cover, a retirement fund and life cover. This article will only focus on the retirement fund and life cover aspects, namely the benefits which arise upon the employee’s death. Those death benefits can be classified as approved or unapproved. Understanding whether your benefits are approved or unapproved is important, as the nature of the benefit has income tax implications which can affect your estate planning.

THE DIFFERENCE BETWEEN APPROVED AND UNAPPROVED BENEFITS

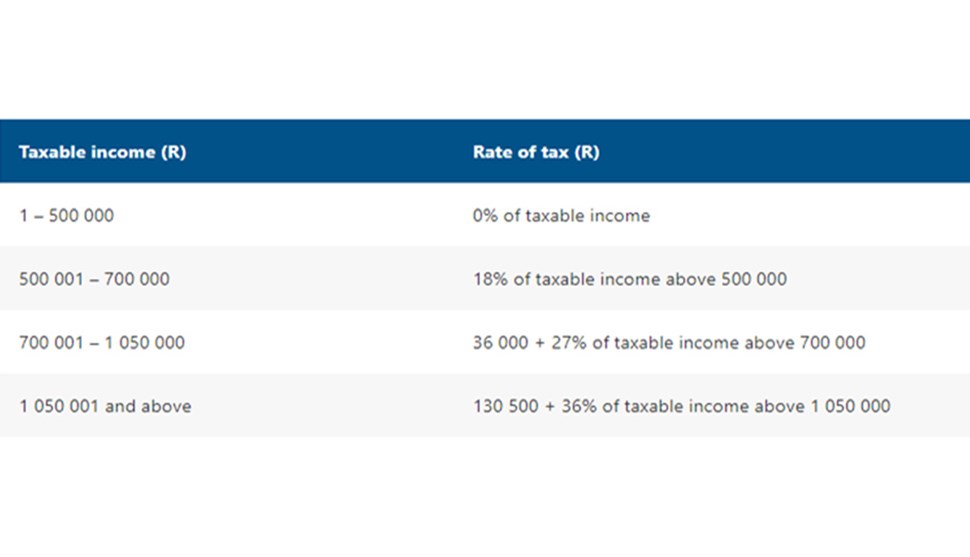

Death benefits from retirement funds are subject to the requirements of Section 37C of the Pension Funds Act and they are taxed in terms of the Second Schedule of the Income Tax Act (see table). The death benefit from life cover that is offered in terms of the rules of an approved retirement fund that is recognised by the Pension funds Act or SARS is referred to as an approved benefit. Unapproved death benefits refer to life cover benefits provided under an insurance contract that exists separate from any retirement fund. The main difference between approved and unapproved life cover benefits is how the member benefits are paid out to the intended beneficiary and taxed.

HOW ARE APPROVED BENEFITS DISPERSED AT DEATH?

When an employee who is a member of an approved group employee scheme dies, their full death benefit which is a combination of retirement fund credit and life cover, pays out as one lump sum. The trustees of the retirement fund are required to follow section 37C of the Pension Funds Act when processing the payment of the benefit and to exercise their discretion between benefiting the dependants and the nominees or nominated beneficiaries based on their needs as determined by the trustees. The trustees will take many factors into account in assessing the payment amount to be allocated between the dependents and nominees. Where there are neither dependents nor nominees, the benefit will be paid into the estate of the deceased.

Income Tax Implications on proceeds: The total lump sum paid out by the retirement fund will equal the retirement fund credit plus the life cover amount. In the event the employee dies the proceeds will be taxed according to the Second Schedule of the Income Tax Act (see tax table at the end of the article).

Estate Duty Implications on proceeds: An approved fund is exempt from estate duty. In terms of section 3(2)(i) of the Estate Duty Act, death benefit proceeds are exempt from estate duty.

HOW ARE UNAPPROVED BENEFITS DISPERSED AT DEATH?

When a beneficiary is nominated the death benefit will be paid to that beneficiary directly. This means there is no trustees discretion as to the ultimate recipients of the benefit, unlike with the approved benefit above. Where no beneficiary is nominated the proceeds will be payable to the employer and the employer will then pay it to the estate of the employee. Unapproved death benefits have two portions, a retirement fund credit and a life cover amount. These two portions are payable to beneficiaries as two separate lump sums.

Income Tax Implications on proceeds: The retirement fund credit will be taxed according to the Second Schedule of the Income Tax Act (see tax table at the end of the article). The life cover proceeds will be included in the gross income of the employee, however, an exemption will apply in terms of section 10(1) (gG) if all contributions were included in the employee’s income as a fringe benefit.

Estate Duty Implications on proceeds: In terms of section 3(2)(i) of the Estate Duty Act, retirement fund proceeds are exempt from estate duty. The life cover is however funded by a long-term insurance policy on the life of an employee and therefore section 3(3)(a) of the Estate Duty Act will apply. This determines that any policy that pays out due to the death of an employee, proceeds will be a deemed asset in the estate of the deceased for estate duty purposes. Should the benefit be payable to the employee’s spouse, section 4(q) will allow for a deduction neutralising the estate duty. This means that should the spouse be the beneficiary, no estate duty is payable, but should a non-spouse be the beneficiary, then one would need to plan for the estate duty payable.

IMPORTANCE OF NOMINATING BENEFICIARIES FOR YOUR BENEFITS

According the Financial Services Board, over R50-billion worth of retirement fund benefits have not been claimed by the rightful beneficiaries. It is therefore vital for an employee with either approved or unapproved benefits to continuously update beneficiary details when their circumstances change. When nominating beneficiaries, the following process can be followed depending on whether the benefits are either approved or unapproved.

Approved Benefits: Approved benefits in most cases require a form to be completed by the employee when nominating a beneficiary. Employees with approved benefits have to constantly update beneficiary details which will equip the trustees of the retirement fund to pay out the benefit to the intended beneficiaries.

Unapproved Benefits: Unapproved benefits require the employee to complete two separate beneficiary nomination forms, the first for the retirement fund portion and the second for the life cover portion. Nominating beneficiaries for the retirement fund portion will ensure that the trustees have a less onerous task in distributing the member’s retirement fund credit to the beneficiaries.

CONSULT AN EXPERT WITH REGARDS TO YOUR GROUP BENEFITS

The reviewing of a members group retirement fund and life cover benefits with the assistance of a wealth advisor is essential. As highlighted in this article, the difference between an approved and unapproved fund can have material implications on the death benefit when tax is taken into consideration. Getting guidance from a professional wealth adviser will ensure a member’s dependants are taken care of by having a solid estate plan in place. The income tax implications on any benefits paid will also be affected by the election that the beneficiary opts for in terms of their receipt of the benefit. Further analysis on this is beyond the scope of this article but suffice to say that the complexities merit professional guidance. Lastly, it is vital that a member keep the beneficiary details up to date and relevant as their state of affairs change. Events such as getting married or divorce, the birth of a child or moving into a home with a life partner, should all necessitate the review of beneficiary nominations.

Table: Second Schedule of the Income Tax Act