In Aspen’s latest financial year ended to 30 June 2020 there were a number of moving parts, which we explore in this note.

1. Firstly, let’s consider the key factor that has stayed the same. What is clear from the FY20 results is that operational headwinds in the pharmaceutical industry remain, that is among others, pricing pressure and now also the pandemic-driven demand shifts. So, one of my key obstacles standing in the way of a high conviction buy, remains in play.

2. Secondly, let’s consider the management imperatives/undertakings of recent years, which have not changed, but progressed.

a. The debt situation continued to improve in FY2020, already moving out of the FY2018 ‘dire’ situation by FY2019 on asset sales and operational dynamics. In FY2020 the net debt to normalised EBITDA improved further to 2.9x (as reported) from 3.6x at FY2019. It should be noted that the FY2020 level is below the temporarily raised covenant level of 3.5x. By my calculation, after applying the proceeds from the recently announced European Thrombosis transaction, to repaying borrowings, net debt to EBITDA will approach 2x.

b. Management have continued to tweak the group’s operations on lessons learned, making good and/or making further progress on undertakings given at the FY2019 investor presentation, including, ‘to re-deploy their capacity to areas where they have scale and actively seek partners with marketing scale to drive their commercialisation in weaker areas‘.

In FY2020, Aspen disposed of the commercial rights to its Thrombosis business in Europe.

I believe it is important to explore the finer details of this move, examining what it is not and what it is, because I get the feeling that, assuming my assessment of the situation is correct, in the recent share price weakness, market participants may be mis-pricing the subtle difference and hence, there may be an alpha opportunity to be realised when the positive impact of the tweaks are realised in the earnings in the medium-term.

What this move is not, is change in strategy. Rather, it is simply a refinement of an unchanged strategy.

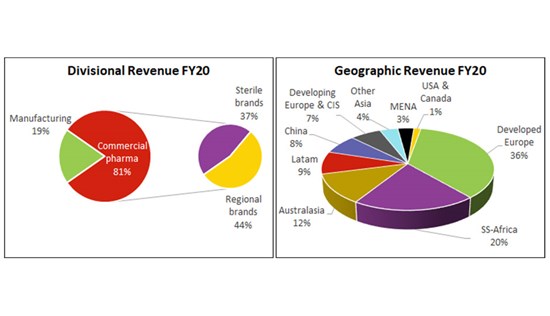

The group strategy remains unchanged, this is, 1) focussing on selected therapeutic categories, 2) owning and having control of the entire value chain from API to finished dose of these therapeutic categories and 3) leveraging the group’s competitive advantage in manufacturing.

The operational refinement of this strategy is the sale (read ‘effectively out-sourcing’) of the finished dose sales function only in Europe/CIS. This has been done to over-come the drag of a sub-critical mass, and hence an inefficient sales force in the region. In so doing, Aspen conserves the substantial capital that that would have to be deployed in Europe/CIS to bring its sales function to scale. Aspen continues to market its Thrombosis products in emerging markets, where it does have a well-developed and established sales force that has critical mass.

Furthermore, in addition to retaining the revenue and profit from manufacturing and supplying the finished dose to Mylan, a more efficient sales force has the potential to drive greater Thrombosis drug sales, positively impacting manufacturing unit cost dynamics for Aspen.

This sounds like prudent capital allocation by management to me.

So all this talk of an ‘emerging market weighted specialty pharma company’ did bother me somewhat, and may add to the market perception of a wholesale change in strategy.

Yes, emerging markets have the benefit of growing populations and increasing medical needs and so, on paper at least, potentially presents a growth opportunity. However, in my opinion, the verdict is still out on whether or not the middle class is increasing (and incomes to afford more ‘things’) in many Emerging Markets (EMs), or even many Developed Market (DM) countries for that matter – a research review throws up many opposing conclusions based on the respective data used by these studies. While these factors may be more evident in China and the south east Asian region, I believe the jury is still out on this ‘massive EM opportunity’, certainly in general terms, and the realised results to date for many companies, underwhelming. And certainly, if one looks at recent examples, many EM strategies have not really worked for many companies, demonstrated by the eventual down-sizing of operations or exit by multi-national companies from territories such as Africa….even a seasoned African investment doyen like Shoprite!

Having said that, I believe Aspen’s geographic diversification and EM/DM exposure balance remains intact with this recent transaction (and potentially similar ones in future), but its source merely changes – from commercial sales to manufacturing revenue.

The information contained in this communication is for information purposes only and does not constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. Terms, conditions and values contained herein are indicative only and subject to negotiation and change. This material does not constitute an offer, advertisement or solicitation for investment, financial or banking services. The material has no regard to the specific investment objectives, financial situation or particular needs of any specific person. The material is based upon information considered reliable, but the parties do not represent that it is accurate or complete or that is can be relied upon as such. All illustrations, forecasts or hypothetical data are for illustrative purposes only and are not guaranteed. Sasfin Wealth accept no liability whatsoever, whether direct, indirect or consequential for any loss or damage of any kind arising out of the use of all or any part of this material and any reader or prospective is urged to be aware of all the risks involved in dealing with any financial product and the need to specifically consult with a professional adviser before making any decision or taking any action. Sasfin Wealth, a division of the Sasfin Bank Group of Companies include Sasfin Securities (Pty) Ltd, 1996/005886/07, a member of the JSE; Sasfin Asset Managers (Pty) Ltd, 2002/003307/07 an authorised financial services provider FSP No. 21664 and Sasfin Financial Advisory Services (Pty) Ltd, 1997/010819/07 an authorised financial services provider FSP No. 5711