2000, 2010, 2020… 2030?

Since the turn of the millennium, the economic and financial landscape has changed significantly. Just in the previous decade much has changed, and ten years from now, even more will, as the pace of change is increasing faster than ever before.

Over the past few years, there has been a clear shift in global equity markets from listed to private markets, particularly in developed markets like the US and Europe. Investing in private markets, once seen as ’alternative‘ investments, are now becoming mainstream according to McKinsey’s latest ’Global Private Markets Review 2019‘.

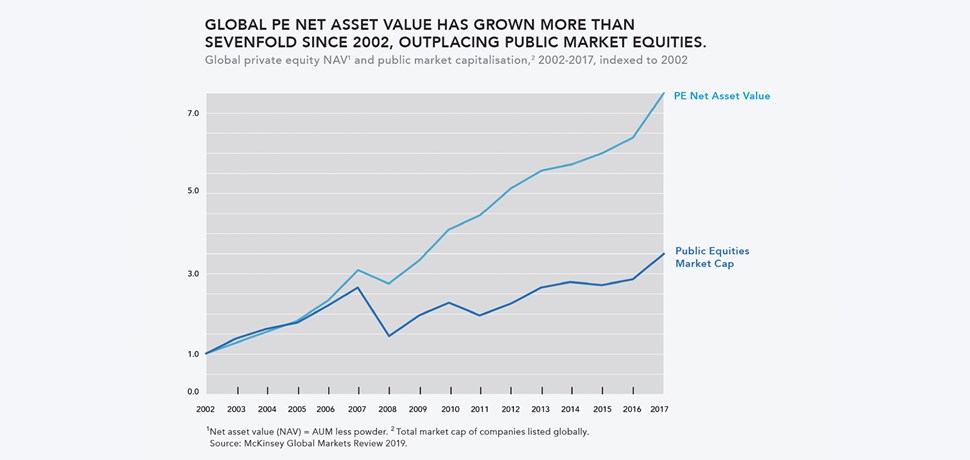

According to McKinsey, global private equity, net asset value has grown 7.5 times since 2002, compared to 3.5 times of growth in public market capitalisation over the same period. From 2006 to 2017, the number of US private equity-backed companies has doubled, while publicly traded companies fell by 16% (and fell by 46% since 1996). 11 years ago, the US had more publicly traded companies than private companies. Today, the US has almost double as many private equity-backed companies than publicly traded companies.

Some of the world’s largest and most sophisticated Investors have significant allocations to private markets (in particular private equity).

It is not uncommon to see private equity allocations exceeding 10%, with some even allocating as much as 20% of their portfolios to private equity. Traditionally, balanced portfolio allocations were done in line with a 60% equity allocation and a 40% bonds allocation. Today, many sophisticated Investors think differently, and it’s a compelling argument to include private equity within the traditional 60% ’equity‘ exposure. If not, an Investor or a pensioner would not be invested in a substantial part of the economy, and true diversification of a portfolio becomes questionable.

Privately owned companies are now amongst the world’s fastest growing businesses, and the probability that they are engaged in the important industries and markets of tomorrow is very high. Private market allocations are becoming essential for Investors, because it represents a growing proportion of economic activity that the pensioner of tomorrow would need to be exposed to today. In fact, we would argue that private equity, in particular, is rapidly becoming an essential exposure to capture the

true long-term equity risk.

South Africa has not experienced this shift from public markets to private markets. However, given the last few years’ weak performance of listed equity markets, many Investors are looking for more attractive equity-like returns. For these reasons, Sasfin Asset Managers (SAM) intends to expand its investment product offerings to include a new Private Equity Fund, managed by a team of specialists with a great track record in the South African private equity industry.

Prior to joining Sasfin, I was the Head of Private Equity at Ashburton Investments. I managed a very successful Private Equity Fund, together with Jake Archer and

James Pullinger. Jake has recently also joined Sasfin, together with Linsa Botha who we also worked with, and who will be providing us with operational support. We will soon be launching and managing the new Sasfin Private Equity Fund called ’Scott Street I‘. This will be the first initiative of SAM in building its private markets capabilities.

Private equity has been largely overlooked as an investment class in South Africa by many institutional Investors, due to some of the shortcomings of the asset class, like for example, its lack of accessibility, lack of liquidity, perception of higher risk, perceived lack of governance, etc. When it comes to governance, being listed (as we have experienced recently) does not necessarily mean better governance.

Private equity involves active management, which, with a competent team of experts managing these Funds, should result in better governance. We believe that the Scott Street Fund series will tick the boxes, addressing the shortfalls of the asset class, while providing Investors with the benefits of the asset class, like investing in inefficient markets, less regulatory burdens (but without sacrificing on governance), and equity returns driven by cash, not market sentiment.

Scott Street 1 will be launched in the first half of 2020. For more information, contact me at

juan.coetzer@sasfin.com