Monthly economic and market review: November 2025

The minutes from the Federal Reserve Bank’s last policy meeting as well as hawkish to noncommittal public comments from some governors put the expected third US rate cut of the year in question.

Pivoting on technology and the Fed

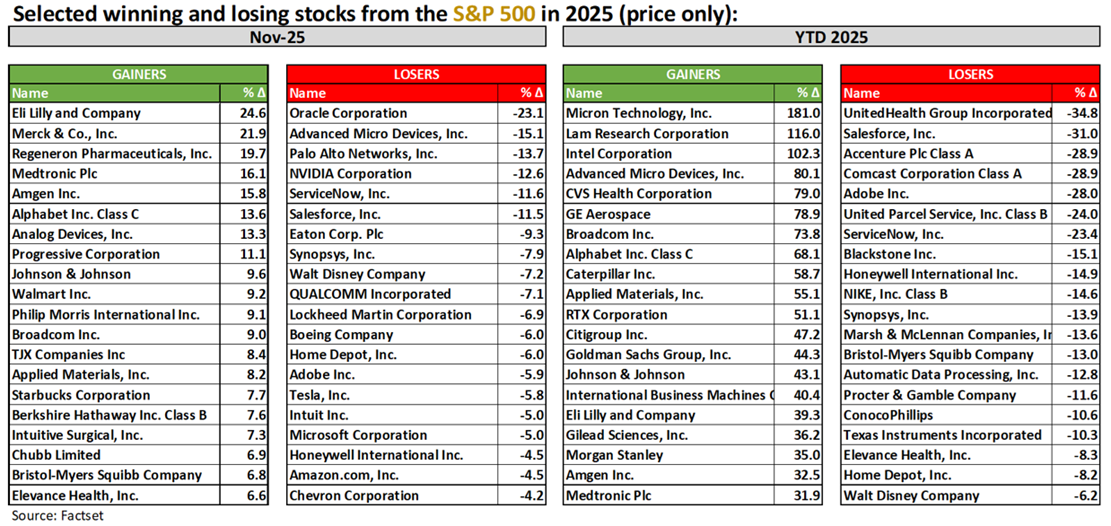

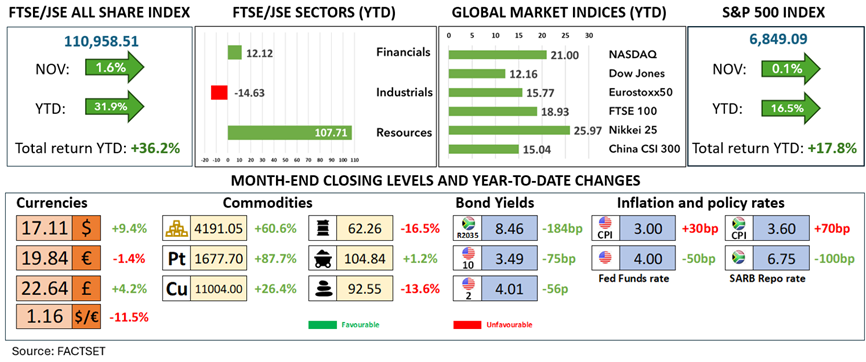

Volatility was the order of the day in November as the markets lost faith in a December Fed rate cut and asked more questions of the technology stocks. The minutes from the Federal Reserve Bank’s last policy meeting as well as hawkish to noncommittal public comments from some governors put the expected third US rate cut of the year in question. This put the market on the back foot and not even the knockout results and guidance from Nvidia could reinvigorate the rally. The Nvidia share price stalled and then fall back as investors began questioning whether the $4 trillion company could maintain such stratospheric earnings growth in light of potential competition from Alphabet’s TPUs (Tensor Processing Units) and their much-lauded new Gemini 3 artificial intelligence model. That model launch helped Alphabet push higher in the month (+13.9%), bucking the negative technology trend. The Technology sector within the S&P 500 fell 4.36% in November with the NASDAQ closing 1.51% lower and Nvidia (-12.6%), Tesla (-5.8%), Microsoft (-5.0%), Amazon (-4.5%) and Meta (-0.1%) all finishing the month in the red. Apple was the only other “Magnificent Seven” stock to register a positive gain, climbing 3.1%. Questions around an AI bubble and concerns around all of the massive, interconnected AI company deals, capital expenditure and debt funding had investors looking elsewhere for returns in November.

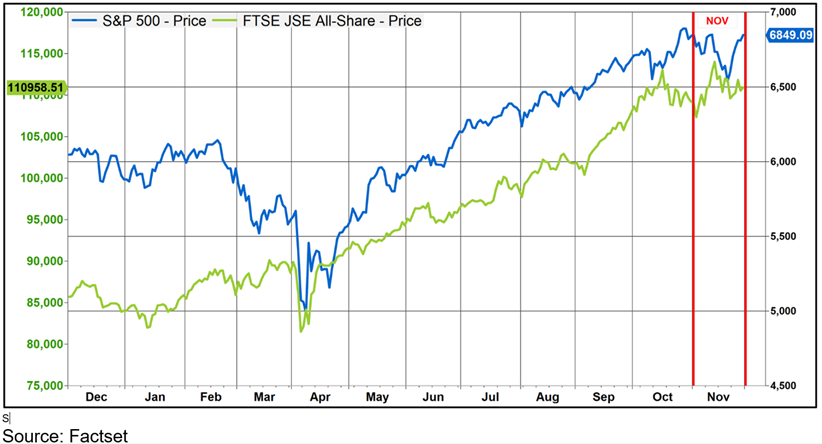

Despite the heavyweight technology stocks closing lower, the S&P 500 managed to record a miniscule 0.13% gain in November, the seventh consecutive monthly gain in 2025 (see chart below). A little more confidence in a December rate returned late in the month to help lift the market higher but the index was also given a helping hand by a strong Healthcare sector. A large contribution was made by Eli Lilly which rose by almost 25% in the month to become the first pharmaceutical company to be worth more than a trillion dollars. Eli Lilly had posted strong results at the end of October and raised its guidance for the year and the positive share price momentum at the end of October continued strongly into November. Merk & Co (+21.9%), Regeneron Pharmaceuticals (+19.7%), Medtronic (+16.1%) and Amgen (+15.8%), all pharmaceutical and biotech companies, rounded out the top five best performing stocks on the market in November.

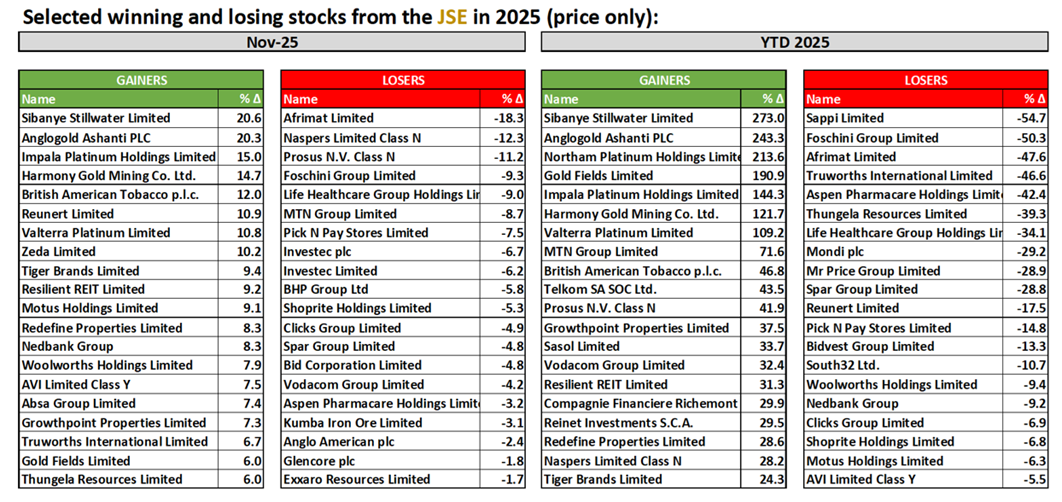

At the end of the month, the sectors that outperformed the 0.13% gain of the S&P 500 included Healthcare (+9.14%), Communication Services (+6.34%), Materials (+3.97%), Consumer Staples (+3.94%), REITS (+1.84%), Energy (+1.76%), Financials (+1.74%) and Utilities (+1.33%). The underperforming sectors included Technology (-4.36%), Consumer Discretionary (-2.44%) and Industrials (-1.01%) - See the tables in the appendix below for some of the larger monthly and year-to-date price movements of stocks drawn from the S&P 500 index and the FTSE/JSE Top 40 index.

The US dollar weakened very modestly during the month ($1.15/€ à $1.16/€) but the gold price went on to close the month at $4,191/oz, a fresh all-time record monthly close. Platinum and palladium both added just over $100/oz and that gave the precious metals rally on the JSE renewed impetus. The Resources sector gained 9.3% in November as Sibanye Stillwater (+20.6%), AngloGold Ashanti (+20.3%), Impala Platinum (+15.0%), Harmony Gold (+14.7%), Valterra Platinum (+10.8%), Gold Fields (+6.0%) and Northam Platinum (+5.1%) jumped higher. These moves left the seven precious metals stocks up between 109% and 273% for the first eleven months of the year. Local market favourites Prosus and Naspers have benefitted this year from ongoing company share buybacks but a 12.3% decline in Naspers and an 11.2% decline in Prosus left the shares up 28.2% and 41.9% for the year-to-date respectively. Management at the two companies updated investors that they would no longer be selling down their holding in Tencent to fund the share buybacks and that created a little concern that the price support provided by the buyback demand would diminish. Tencent itself was down around 3% in November and that also worked against Naspers and Prosus in the month.

Many of the big losers on the JSE this year have been those companies more closely tied to the health of the South African economy. The list is littered with retailers (food and clothing) and even the bluest of our local blue chip shares have not been spared. Very pedestrian economic growth and weak confidence have not helped but recently we have seen some green shoots pushing through. South Africa managed to be removed from the Financial Action Task Force’s grey list, S&P Global Ratings upgraded our sovereign credit rating, the Medium-Term Budget Policy was well received, the finance minister formally introduced a 3% inflation target, the South African Reserve Bank cut interest rates again, bond yields continued to fall and the rand maintained its strength against the currency crosses. As a result, the banks and selected retailers had a better time of it in November. The listed property stocks were also largely in the green, given the tailwind of the lower interest rate environment. When all was said and done in the month, the FTSE/JSE All Share index was up by 1.6%, its ninth consecutive monthly gain and its tenth monthly gain out of 11 months this year. February’s miniscule 0.02% index decline was the only blot on the JSE’s copybook this year (see chart below).

S&P 500 (blue, RHS) & FTSE/JSE All Share Index (green, LHS) – last 12 months

With great valuations comes great responsibility (to deliver earnings)

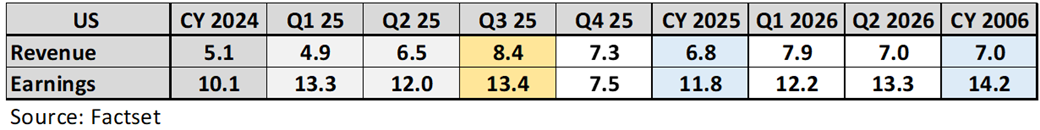

The third quarter US reporting season has all but ended and the published numbers have well-exceeded analysts’ expectations. Revenue growth of 8.4% y/y and earnings growth of 13.4% y/y were much stronger than even believed just a quarter ago. The positive results and better-then-expected guidance have also improved the expected earnings growth for the quarters to come. The fourth quarter earnings season will kick off on 13 January when the large banking groups start reporting and another good quarter of revenue and earnings growth is expected to lead to growth of 6.8% in revenue and 11.8% in earnings for calendar year 2025. From the table below it can be seen that expected margin improvements should help turn revenue growth of 7.0% in 2026 into earnings grow of 14.2%. That should help underpin the markets in 2026 but investors will always be looking to the sustainability of growth and will want to be reassured quarter by quarter that the current rate of growth can be maintained. With these high expectations baked into high valuations, we have seen that individual companies that fall short of market expectations or who provide softer guidance are given harsh treatment. There is absolutely no room to disappoint.

For the local market we’ll want to see some of those green shoots growing into little shrubs. The precious metals complex can’t maintain the stratospheric levels of growth seen this year and the rest of the market will need to come to the party to drive the FTSE/JSE All Share Index higher. The catalyst for that is economic growth. The new inflation target and the structural shift lower in market interest rates should provide significant support but apart from monetary stimulus, we’ll need to see a government delivering on their fiscal promises of infrastructure investment and we’ll need to see what support the private sector can provide to help solve for our country’s investment and growth shortcomings. With less restrictive monetary policy, an accommodating fiscal policy and strong private sector involvement, we can make a step-change to our potential growth rate and the stock market would simply lap that up.

Appendix: Market Movers