The tariff winds blow hot and cold.

“…'Cause you're hot then you're cold, you're yes then you're no, you're in then you're out, you're up, then you're down. You're wrong when it's right, it's black, and it's white. We fight, we break up, we kiss, we make up….” Katy Perry (2008).

In Katy Perry’s Grammy-nominated hit “Hot N Cold” she sings of a relationship soured by the mood swings of one of the partners. Happiness and contentment for the couple are unattainable when one person in the party behaves one way in a certain moment only to behave very differently in the next. The many policy swings emanating from the White House have left observers seeing President Trump as that mood-swinging partner. Party faithful will rebut with claims of an artful negotiator craftily enacting “The Art of the Deal” and adapting where necessary but the many policy about-faces, particularly around tariffs, have only served to sour US relationships around the globe and led others to bemoan the inconsistency and unpredictability of policy. Financial Times columnist Robert Armstrong encapsulated some of this notion when he adopted the term TACO, "Trump Always Chickens Out."

Armstrong contended that President Trump usually comes out with both guns blazing but when strongly confronted (by weak markets, unyielding opposition or legal challenges), he backs down. The 90-day pause on the Liberation Day tariffs, the one-month pause on the 50% European Union tariffs and the rescinding of triple digit tariffs on China are cited as examples. The Trump Administration’s revocation of Harvard University’s certification to enrol foreigners meant that 6,800 foreign students were being forced to leave the university but legal action brought by Harvard provided those international students with a temporary reprieve. The public outcry around the revocation of the certification and Trump’s later comments that foreign students should potentially only make up 15% of Harvard’s student body lay the foundation for a potentially permanent reprieve. Nevertheless, this incident provides further ammunition for the TACO believers.

TACO Tuesday, and Wednesday, and Thursday …

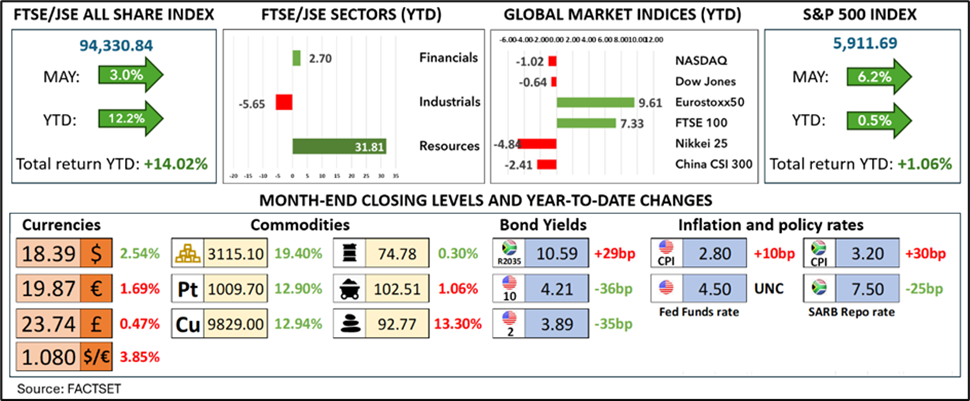

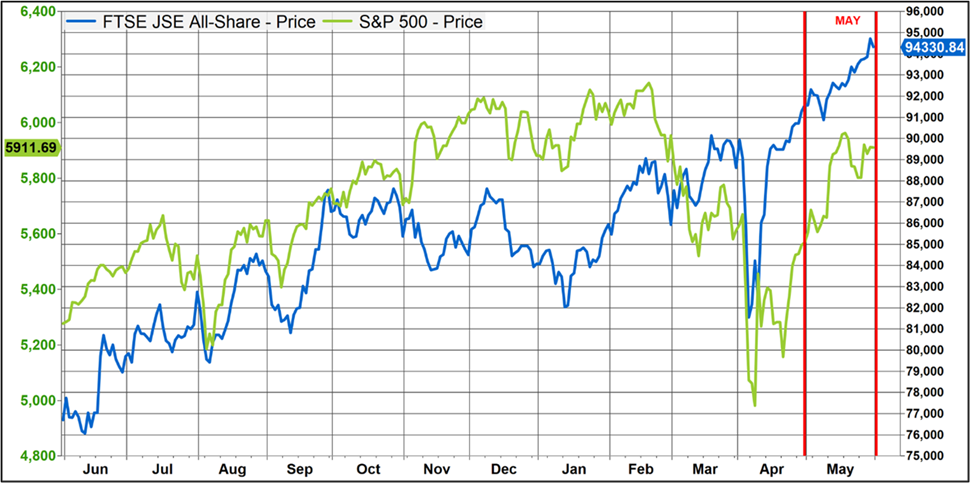

The TACO trade has also become a thing. Sell the market when Trump blurts out a new policy and after the inevitable market sell-off and the resulting Trump standdown, buy it back. BUY the Liberation Day market collapse, SELL the 90-day pause market rally. The month of May was all about the de-escalation of the tariff war between the US and China and the market lapped up news that the parties were talking to each other and taking the tit-for-tat triple-digit tariffs off the table, at least for 90 days. The US revised its tariff on Chinese imports from 145% to 30% while China revised its tariff on US imports from 125% to 10%. The market rally was quick and decisive and the S&P 500 gained 6% over a 10-day period (see the green line in the graph below). The postponement of the 50% tariff on goods from Europe until 9 July left the market with a firmer undertone towards month-end but the hiking of tariffs on steel and aluminium imports into the US from 25% to 50% in the last days of the month raised concerns again that the tariff war was far from over.

The US markets also successfully negotiated the first quarter earnings reporting season over April/May and the solid numbers from Nvidia on the 29th of May allowed the market to breathe a collective sigh of relief. Technology stocks led the way higher in May and the sector returned 10.79% against the return of the NASDAQ Composite of 9.56%. Communication Services (+9.61%), Consumer Discretionary (+9.38%) and Industrials (+8.63%) also outperformed the 6.2% return of the S&P 500 in May. Financials (+4.29%), Utilities (+3.36%), Materials (+2.80%), Consumer Staples (+1.66%), Real Estate (+0.85%), Energy (+0.30%) and Healthcare (-5.72%) all underperformed the index. The Healthcare sector has faced numerous headwinds under the new administration and heavyweight UnitedHealth has been on the back foot all year. The company fell short of earnings expectations with its first quarter results and management also provided a weaker outlook for the year ahead. Headlines of investigations into potential Medicare fraud at the company finally sent the share price reeling and the counter lost 26.6% in May to take its decline this year to 40.3%. Overall, the strong showing of the S&P 500 in May, its best monthly gain since the 8.9% in November 2023, lifted the index back into positive territory for the year (+0.51%) with a total return of 1.06%.

FTSE/JSE All Share Index (blue, RHS) & S&P 500 (green, RHS) – last 12 months

The local market carried on where it left off in April and after the all-time high posted on 30 April, the FTSE/JSE All Share index went on to record nine new record highs in May. The index slipped back from its all-time peak on 29 May of 94,726 index points on the last day of the trading month to close up 3.0% for the month and 12.2% for the year-to-date – a total return of 14.02%. The market gains have not been broad-based and the heavy lifting has been done by the Resources sector which closed 31.81% up for 2025 so far as the gold price gained 25.62% and the platinum price rose 17.6%. The gold miners have provided 60%-80%-type returns this year while the returns from the platinum miners have ranged from 24% to 66%. Richemont (+21.9%), Anheuser Busch (35%), British American Tobacco (19.7%), Naspers (+23.7%), Prosus (+22.8%) and the big telecoms stocks (+35.9%) have provided strong returns but the “SA Inc” shares, particularly the retailers have fared poorly in the weak domestic economic environment. At a sectoral level, Financials have managed a 2.7% gain year-to-date but Industrials have lagged with a decline of 5.65% in 2025 so far.

See the appendix below for a broader list of market movers on the JSE and the S&P 500 during the month and the first five months of the year so far.

Tariffs come and tariffs go and what to do, you just don’t know

The Liberation Day tariff announcements set the cat amongst the pigeons and analysts around the globe rushed back to their drawing boards to try and determine the impact on growth, inflation and interest rates. Fiscal authorities and central bankers found themselves also having to review their assumptions and forecasts but the “Hot N Cold”, on-again, off-again nature of the tariffs made for difficult analysis and decision-making. The Federal Reserve Bank, much to President Trump’s chagrin, has been opting to wait for greater clarity before adjusting policy and opted again in May to keep the official policy rate unchanged. The Federal Reserve has reduced rates just three times in this cycle (100 basis points in total), with the last cut being in December 2024. Despite the European Bank having cut rates at a faster pace (seven cuts totalling 210 basis points), the US dollar has weakened from its best level of $1.02/€ in mid-January to $1.14/€ at end-May. The greenback was unchanged over the month but did have a brief foray to $1.11/€ before weakening again. The market is still anticipating around two 25 basis point cuts from the Federal Reserve this year but the magnitude of any easing will depend upon how the tariff story plays out in the months ahead. US bond yields did kick up in the month as equities returned to favour and the prospect of a rate cut were pushed out further. Two-year bonds yields rose 31 basis points (to 3.90%) while the 10-year yield climbed 23 basis points to 4.39%.

The South African Reserve Bank had also adopted a cautious stance amidst all of the uncertainty but with inflation below the bottom of the 3-6% target range in an environment of weak demand they relented and cut the repo rate by 25 basis points at the end of May. This followed no change to policy in March and a 25 basis point cut at the January meeting (a total of 100 basis points of easing in this cycle through four rate cuts). Local 10-year bonds ended the month 48 basis points lower (at 10.09) after safely negotiating the third iteration of the National Budget which the finance minister presented on the 21st of May. The proposed VAT rate hikes of the first budget were withdrawn in favour of a hike in the fuel levy and some expenditure reductions but the lower economic growth assumption of 1.4% for this year pushed the deficit wider to 4.8% of GDP. This in turn increased the peak of gross debt to 77.4% of GDP and increased debt servicing costs to R426.3bn this year (equivalent to 22c of every R1 of tax collected).

Whereto for big, beautiful earnings?

Corporates have also had to contend with the uncertainty of their operating environments and forecasting revenues and earnings has been made that much more difficult. US first quarter earnings growth was ahead of expectations but earnings forecasts for the coming quarters have been reduced. A slowing US economy in a slowing global economy has seen revenue expectations moderated. Many companies will pass on the cost of tariffs to end-users but some will, in Trump’s terminology, “eat the tariffs”, or at least absorb part of the higher input costs. That will reduce margins and bottom-line profits and analysts have already cooled their expectations for company earnings for the coming quarters. The table below reflects the consensus earnings outlook from FACTSET for the remainder of 2025 and for the 2026 year.

As far as valuations go, the trailing 12-month price/earnings (“P/E”) ratio of the S&P 500 is 25.9x, which is above the five-year average of 24.8x and above the 10-year average of 22.4x. Looking ahead, the forward 12-month P/E ratio for the S&P 500 is 21.3x which is above the five-year average of 19.9x and above the 10-year average of 18.4x. The market is a little ahead of its historical valuations but should the market rating remain unchanged and the earnings grow as forecast above, the market will return 9.1% this year. Any market de-rating would result in a lower return while a re-rating would result in a higher return. Over the next 12 months to end-May 2026, analysts are currently forecasting a market price return of 11%.

On the JSE, the trailing 12-month price/earnings ratio of the benchmark FTSE/JSE All Share index is 15.7x, which is above the five-year average of 14.5x but below the 10-year average of 16.8x. Looking ahead, the forward 12-month P/E ratio for the JSE is 10.4x which is almost the same as the five-year average of 10.3x but below the 10-year average of 12.3x. The market has seen a positive re-rating over the past year and is not the single digit P/E dripping roast that it presented as in the recent past. Nevertheless, the multi-faceted nature of the JSE means that investors should be looking at stock selection and sector selection rather than tarring all stocks with the same market P/E brush.

Overall, May was a great month for the equity markets but one can’t get complacent. The tariff pause for Europe will end on the 9th of July and the 90-day Reciprocal Tariff Pause that followed Liberation Day expires on the 8th of July. The 90-day pause on tariffs imposed on China expires on the 10th of August. The can has been kicked down the road but what happens next? Will more permanent deals be inked? Will the pause periods be extended? Will the pauses expire only for tariffs to be hiked again? The markets are pricing in a positive outcome but the outcome is still uncertain and leaves room for disappointment. When the tariff dust settles wherever it’s going to settle, we still need to see the impact on growth, inflation, interest rates, earnings and share prices. The uncertain outcomes of the various conflicts around the globe also make the market crystal ball that much mistier. However, while some corporate or market dynamics might shift and evolve post this era of trade disruption, the long-term structurally positive growth path for equities will remain.

We don’t know who Katy Perry was singing about with the words “you change your mind like a girl changes clothes” but let’s all hope that eventually everybody does “kiss and make up”.