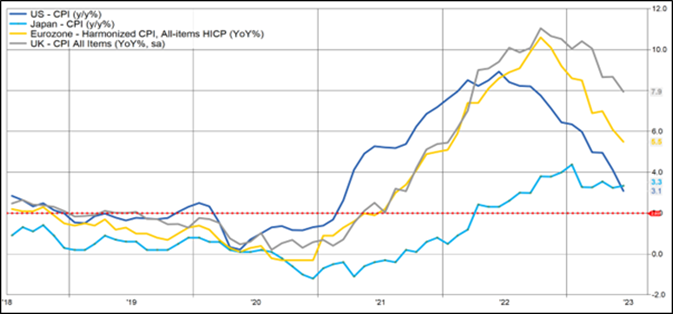

Central banks continued their tightening of monetary policy in July even as inflation continued to slow. The chart below reflects the course of headline consumer price inflation in developed markets over the past five years, with peak inflation in 2022 and disinflation up to the present time. Inflation has been most stubborn in the UK with a peak of 11.1% in October last year and a most recent print of 7.9%. In the Eurozone, consumer price inflation topped out at 10.6% in October last year but slowed to 5.5% at the June reading. US inflation peaked earlier than in Europe, with a high of 9.1% in June last year and a print of 3.1% this June. Japan, in turn, has been crying out for some inflation for decades and after a period of deflation over 2020-2021, inflation picked up to a January 2023 peak of 4.1%. That peak was short-lived and headline consumer price inflation has been stuck in a narrow range between 3.2% and 3.6% since that time.

The central banks overseeing these four countries/regions all have a 2%-point inflation target and monetary policy tightening has continued as published inflation rates have remained above the target level (the 2% target line indicated in red below). While headline inflation has been heading in the right direction, policymakers have focussed on “core” inflation i.e. headline inflation that excludes the more volatile and extraneous food and energy prices. Stripping those factors out to calculate core consumer price inflation is meant to represent the inflation that is demand-driven and more responsive to changes in interest rates. Central bankers can do little to change the course of food or fuel prices but they can impact demand for other goods and services by increasing interest rates. Core inflation has been a lot “stickier” than headline inflation in that it hasn’t declined at the same pace and central bankers have focussed their policy responses on driving core inflation back to target levels. Higher interest rates and hawkish utterances from central bankers have all been designed to reduce demand (slow economies down), drive expectations of future inflation rates lower and push core inflation measures back to the target. The challenge facing those making all of the tough decisions is to decide when enough is enough. Higher interest rates take time to do their work and central bankers have to continually assess the likely lagged impact on the economy of all of their rate hikes to date. Leave it too late and the economy might move deeply into recession but don’t do enough and you won’t combat the inflation problem. The markets have been trying to second guess every next move of the central banks and have generally been taking the view that we’re near the peak of the interest rate cycle. The rate hikes by the Federal Reserve Bank and the European Central Bank in July were considered by the markets to be the last (or at the very worst, the penultimate hike in Europe) and that buoyed the financial markets during the month.

Developed market inflation rates: 2018 - 2023

Source: Factset

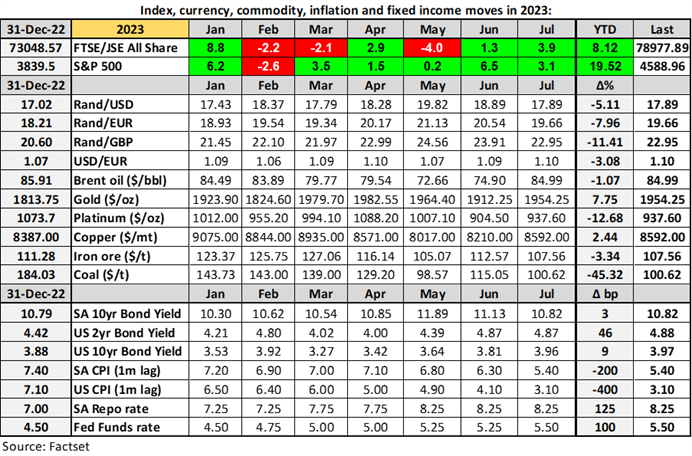

On the resources front, Brent crude oil prices rose $10 in July as Saudi Arabia’s additional voluntary production cuts were implemented and as the OPEC+ heavyweight announced that those production cuts would continue into August. Commodity prices were generally mixed in the month with gold, platinum and copper prices marginally higher and iron ore and coal prices lower (see table below). The rand continued to appreciate from the very weak levels recorded in May and the currency gained against all of the major crosses over the past month. At end-July the rand had recovered to be down “just” 5% against the US dollar this year. The dollar in turn was marginally weaker in the month as investors started believing increasingly more that the 25 basis point rate hike effected by the Federal Reserve Bank in July would be the peak in the current interest rate cycle. The rand’s strength in the month came despite the South African Reserve Bank keeping the repo rate unchanged at its July meeting. With headline consumer price inflation falling back into the target range (5.4% for June) and firmly on its way back to the midpoint of the range in 2024, the expectation remains that the local central bank has also come to the end of its policy tightening in this interest rate cycle. Bond yields in both the US and South Africa remain elevated and are still considered to offer value ahead of potential central bank pivots during the course of 2024.

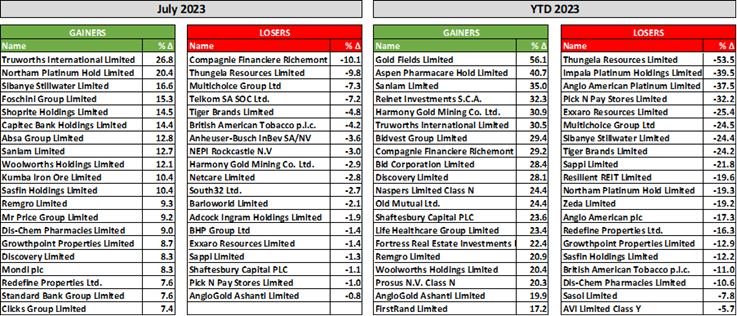

The table below reflects some of the JSE’s biggest winners and losers in the month of July and for the first seven months of this year. Truworths, which had experienced an up and down year before July, rose almost 27% in the month after it posted a strong 53-week business update on 20 July. That left the share price 30.5% higher this year and amongst the best performers on the local equity market in 2023. The clothing retail sector generally found favour in July with Foschini up 15.3%, Woolworths up 12.1% and Mr Price up 9.2%. Northam management accepted Implats’ R90 per share offer for their 34.5% stake in RBPlats and the finality to the battle for RBPlats found favour with Northam shareholders who saw their shares rise 20.4% in the month. That still left the shares down 19.3% for the year to date and in the company of the other big platinum miners on the losers list (Angloplat -37.5%, Implats -39.5%, Sibanye Stillwater -24.4%). The large local banks also had a good month (Capitec +14.4%, Absa up 12.8%, Standard Bank up 7.6% and FirstRand up 6.3%) although Capitec and Absa remain modestly in the red for this year so far. Richemont was the biggest large capitalisation loser in the month with a decline of 10.1% but the counter remains almost 30% higher than where it started the year. The gainers list for the year so far remains an eclectic mix of mining, financial and industrial companies with Gold Fields leading the way with a capital return of 56.1% in 2023.

Selected winning and losing stocks on the JSE over July and 2023 year-to-date (price only):

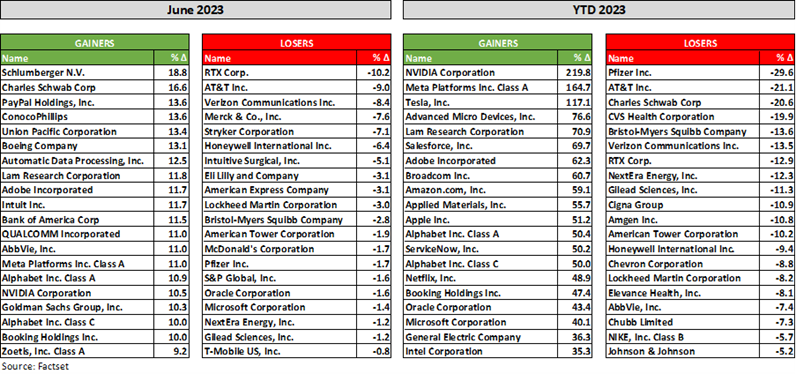

Apart from renewed expectations around a Federal Reserve Bank interest rate peak and a near-term policy pivot, global equity markets were buoyed by the positive earnings results and outlooks from the vast majority of the S&P 500 companies that reported results in July (about half reported in the month). Despite generally strong earnings beats and fair sales beats in the Q2 results, the market punished any misses and only moderately rewarded the beats. The table below highlights the leading winners and losers from the 100 largest S&P 500 stocks in both July and the first seven months of 2023. A total of 70% of the top 100 posted a price gain during the month. The artificial intelligence narrative gained further traction in July while the longer-term growth prospects for the big tech companies was reinforced. Nvidia remains the poster child for artificial intelligence and was up a further 10.5% in July to leave it up 220% for the year. The pickup in global travel to pre-pandemic levels has also boosted many of the aerospace and travel/tourism counters. Declining inflation has been a prerequisite for the Fed pivot but it has put pressure on sales growth and the ability to push through further price increases to protect margins, particularly when labour costs have been sticky amidst tight labour markets.

Top winning and losing stocks from the 100 largest S&P 500 companies in July and 2023:

The S&P 500 index notched up its fifth consecutive monthly gain in July (+3.1%) to be up 19.5% in 2023 so far. The FTSE/JSE All Share Index turned in its second-best month of the year (+3.9%) to be up 8.1% in 2023. Given the rand’s depreciation this year, that translates into a US dollar return of 3.1%. Future market direction will be dictated by the remaining results in this quarter’s US reporting season and any progression of the ongoing interest rate pivot saga. With the S&P 500 up almost 20% this year and with quarterly earnings declining, equity valuations have generally moved into more expensive territory. That equity story is playing out as bond yields remain elevated and offer some attraction for a future where economic growth will be slower, inflation will be lower and interest rates will be falling. Corporate earnings growth is expected to resume from the next quarter and that will help support valuations but the market will likely have little patience for earnings misses or bad news in the shorter term. Some market retracement or pause during the second half of the year is very possible and should that transpire, it will be a welcome opportunity to get into those counters that have run as hard as the filly with the outside draw at the Durban July.