A sharp rise in longer-term interest rates has begun to weigh on global equity markets. While the MSCI All Country World Index, a benchmark for global equity markets, gained 2% during February, most of the gains from earlier in the month were wiped out as the 10-year US Treasury yield climbed above 1.5% for the first time in over a year before closing the month slightly below this level at 1.4%. The 10-Year US Treasury yield is one of the most, if not the most, influential interest rate in in global financial markets.

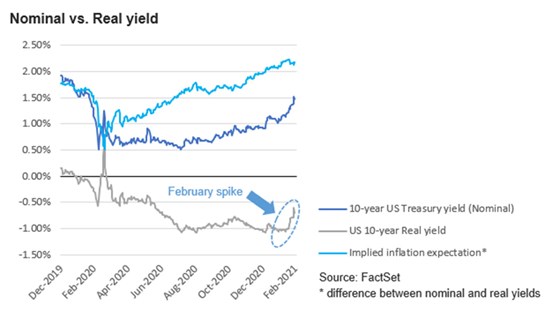

The rise in the longer-term US 10-year Treasury yield is not a new development as it has been edging higher since August last year, most likely driven by expectations of higher inflation. The recent spike however appears to be predominantly driven by prospects of stronger real economic growth. The US 10-year Treasury yield is a nominal rate which means it is composed of a both an inflation element and a “real” element. Stripping out the inflation element leaves you with the real rate of interest. One factor that influences the level of real interest rates is the potential growth rate of the economy. The rollout of vaccines coupled with ample financial stimulus and pent-up demand is expected to lead to a boost in economic growth. The US 10-year Real yield has been lingering around the negative 1.0% level since August last year, despite the (Nominal) 10-year US Treasury yield edging higher, but the recent spike in the US 10-year Real yield suggests that the market is anticipating higher economic growth. Reading further into the rising longer-term treasury yields, the market may also be anticipating a rate hike sooner than what the US Federal Reserve (“Fed”) had previously suggested.

This may be due, in part, to the next round of stimulus currently working its way through the halls of the US Congress. The $1.9 trillion package, which is expected to come less than three months after the previous relief package of $900 billion, has garnered fears that the US economy is set to overheat. Despite these fears, the Fed has previously stated that it would allow inflation to run higher without hiking rates at least until 2023.

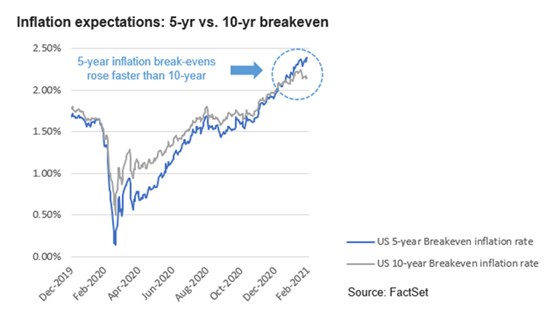

Such accommodative policies and vast amounts of fiscal stimulus could lead to higher inflation but to what extent. Implied inflation expectations seem to suggest future inflation levels of slightly over 2%. From a timing perspective, the market appears to be anticipating an up-tick in inflation over the medium term and to subsequently ease based on a comparison between the 5 and 10 year inflation break-evens for the US.

Despite the prospect of higher inflation, it is worth considering some structural trends which would lead to lower inflation over the longer term, at least in developed economies. These trends include demographic changes such as aging populations which stifles economic growth, rising inequality which lowers aggregate demand from lower income groups and technological developments which have alleviated many supply bottlenecks.

Returning to the matter of falling equity prices in light of rising longer-term rates, one might ask what the one has to do with the other. For many but not all, the value of an asset is the present value of its discounted cash flows. As such there exists an inverse relationship between the value of the asset and the rate at which it is discounted. In the case of equities, with interest rates increasing, the rate at which its future cash flows or profits are discounted has increased resulting in lower equity valuations. While the S&P 500 Index (+3%) ended the month higher than the STOXX Europe 600 Index (+2%) and FTSE 100 (+1%) the impact of the spike in interest rates was felt more so by US stocks than its European counterparts as the US experienced larger declines in equity prices. The decline in the S&P 500 Index was further compounded by the fact that it has a large weighting towards Big Tech stocks which are long-duration growth stocks (stocks expected to deliver a higher proportion of future cash flows in the distant future) and such stocks are more sensitive to changes in longer-term interest rates, specifically real rates.

The price of oil has returned to its pre-pandemic levels as Brent crude and West Texas Intermediate hit $60 a barrel for the first time in over a year. During 2020 prices sank below $20 a barrel as oil demand has remained depressed since the onset of the pandemic but a number of factors have combined to drag prices higher. These factors include an improving growth outlook supported by the global vaccine roll-out, Saudi Arabia cutting its production by a million barrels a day during January, demand for oil in China has been strong and declining oil inventory levels around the globe, specifically the US.

The price of gold, perhaps surprisingly, has continued to decline falling below the $1,800/ozt level to end the month at $1,728/ozt. One might have thought that a falling dollar, an accommodative monetary environment, vast amounts of fiscal stimulus and rising inflation expectations would all provide a perfect environment for the price of gold to rise. The price of the yellow metal may still rise against such a backdrop but for the moment, we may need to once again look at rising treasury yields which in turn increase the opportunity cost of holding bullion and therefore negatively impact the price of gold.

The fall in the gold price continues to have a negative impact on the share prices of South African gold miners as the JSE Gold Mining Index declined 5% during the month. Despite gold miners weighing on the local market, the JSE All Share Index ended the month 6% higher on the back of strong performances from diversified miners Anglo American, BHP and Glencore. The mining giants have benefited from soaring commodity prices, in particular the prices of iron ore and copper have increased 100% and 65% respectively over the past year. Shareholders in the diversified mining groups will also be rewarded with hefty dividend payouts as management has opted to allocate a large portion of the uptick in company cash flows towards dividends rather than stake it on risky projects.

A final comment must be made on bitcoin. The cryptocurrency experienced a dramatic rise during the month ascending above $57,000, a near 75% increase from the beginning of the month, before falling to end the month around the $47,000 level. Growing concerns over the accommodative policies of central banks as well as their ballooning balance sheets are the likely drivers behind the skyrocketing price of cryptocurrency. Bitcoin continues to gain acceptance as it grows in popularity, in particular from payment companies such as Mastercard, Visa and PayPal. Even Elon Musk is offering Tesla customers the ability to pay using the cryptocurrency. Incidentally, Tesla bought $1.5 billion worth of bitcoin during the month. Despite its growing acceptance many still believe that bitcoin is but a “bubble”, sighting no fundamental value behind the digital asset. Bitcoin sceptics believe the accommodative monetary environment and low interest rates have led to funds flowing into risky assets, with bitcoin in particular being a key beneficiary. Interestingly, the fall in the price of bitcoin coincided with the recent spike in interest rates.