At the start of 2022, expectations were that the Covid-related supply chain disruptions causing inflation would begin to moderate, the US Fed would gradually normalise monetary policy without disrupting the economy, and China would begin to grow at a rate above 6% again.

All these expectations however changed dramatically during the 1st quarter as we saw Russia invade Ukraine, despite staunchly insisting they would not, until they did. The geopolitical re-alignment we saw in the aftermath of the invasion has been radical in the speed at which it happened as well as the implications.

Prior to the Russian aggression, NATO and the “West” were seen as politically weak, divided, and distracted by domestic issues. It became clear that the Biden administration was able to bridge the political and military gaps much faster than what Putin may have believed and accordingly what was initially expected to be a short-lived military takeover has morphed into a proxy war. Russia’s military capability has been shown to be overrated and with the imposition of biting economic sanctions, their economy will struggle to avoid a deep and lasting recession.

As a major supplier of key industrial commodities as well as oil, gas and fertiliser saw a number of steep price rises in these commodities, exacerbating the still lingering global supply chain disruptions. This saw inflation expectations ratchet higher, forcing the Fed to re-evaluate the inflation trajectory.

More recently, over this period another outbreak of Covid emerged in China, and their insistence on a zero-Covid policy necessitated the imposition of even stricter lockdowns across a number of major cities. As a key player in global manufacturing supply chain, these lockdowns will now exacerbate the current global inflation surge, and accordingly in the US the Fed will be forced to resort to an even more hawkish stance than before.

This faster pace of required rate hikes has led to a substantial increase in the possibility of a global recession – this will be the trade-off in order to bring inflation back to targeted levels. However, another outcome of this stagflationary episode will be that earnings growth expectations will need to be adjusted downwards, and this has already triggered a substantial de-rating of many stocks which had high growth expectations embedded in their prices.

In the bond market the fact that inflation will remain higher for longer also saw a substantial sell-off, with 10-year yields peaking over 3.0%, which whilst still some way off the US inflation rate of 8%, is a massive move from the 1.5% that it started at in January.

On the back of the elevated commodity prices, our resource sector has benefitted enormously, even leading to government revenue overruns locally. Whilst initially remaining much stronger than expected, the Rand eventually gave way to the US dollar as the elevated hawkish nature of the Fed implied more rate hikes, whilst the potential of a global recession also saw some commodities come off the boil. However, whilst off their peaks, local resource stocks still remain at fairly cheap valuation multiples and it is still expected that, looking through the cycle, on a relative basis the sector will continue to do well.

A key issue locally is how our economy will be able to tolerate a hawkish SARB that may be induced into more rate hikes than expected by an inflation trajectory that will be largely driven by causality factors out of their control. We have already noted that a number of emerging markets have experienced social unrest and riots as food prices have risen, and we have no doubt that in an inflationary environment where food and fuel prices play such a key role in the finances of the poor, it is likely that South Africa too will experience severe socio-economic stresses. This risk will need to be factored into markets.

We favour the global growth equation over the South African one, but much of our expected underperformance is already factored into valuations – on both bonds and equities. In particular our bond yields on a real yield basis look exceptionally attractive. However, if the global inflation wave continues, there is a risk that the relatively muted local inflation expectations would ratchet higher, meaning the inflation risk premium in nominal bonds is not as high as required.

One key focus at this time of volatility, both locally and globally, will be a focus on quality and resilience, and certainly prices and valuations will reflect this.

In our analysis, the key issues that markets will face during the next 12-18 months:

The importance of these issues cannot be emphasised enough – we are seeing essentially 3 overlapping shifts taking place simultaneously – a normal growth/inflation cycle, a macroeconomic paradigm shift in the sense of generation high inflation rates, and the geopolitical paradigm shift. The net result is that there can be no return to “normal” in the sense of what the global economy looked like pre-Covid. In this respect then, it requires a re-calibration of growth prospects and a concomitant reduction in forecast earnings. This adjustment is already taking place, but there are some market segments that will still face significant pain ahead.

We continue then with our previous scenarios:

A ‘bullish’ one, where none of the worst risks in these issues are realised, but the outcome would still imply heightened volatility for markets, with the backdrop of already strained valuations in some market segments. This would require only modest further tightening from the Fed – with inflation levels gradually dropping off to settle at levels around 3% and no global recession occurs. In such a scenario we would expect to see only 4-5 further rate hikes.

A bearish scenario would see inflation, driven by the combination of Covid supply chain disruptions, overly easy monetary policy, the war in Ukraine and China’s Covid lockdowns, remain stubbornly high. A steep rise in inflation expectations causes Central Banks to raise rates further than generally expected and triggers a short, sharp global recession and a further market sell-off. Here we would expect to see 7-9 further rate hikes in the US.

Our base case here lies somewhere between these 2 scenarios and with the backdrop of the paradigm shifts we detailed earlier we foresee mild growth contraction but no widespread recession. This would be inherently disinflationary, and we would see inflation dropping off current elevated levels, but, importantly, not back to pre-Covid levels. This is important as it speaks to where US Treasury bond yields find equilibrium, which we expect to be between 3.0 - 3.5%.

If we turn again to the local scenarios, we remain reasonably confident that there is very little room for truly significant policy shifts from government, and our monetary policy tightening is always going to be constrained. The risks are rising for socio-economic stresses spilling over again into unrest, and therefore, despite our terms of trade remaining fairly positive, South Africa as an investment destination remains limited for now.

The danger of inflation exceeding the upper limit of the SA Reserve Bank target has increased, with massive pressure from soaring oil, wheat, and other commodity prices, as well as administered price rises (electricity, water, rates). Supply chain challenges following COVID restrictions around the world and in particular China’s zero COVID policy have added to cost pressures, as will the KZN floods and the delays at the Durban port in the short term. The SA Reserve Bank is therefore widely expected to further hike interest rates. Nevertheless with 10-year bond rates of over 10%, we believe that investors are adequately compensated for risk and accordingly over the past year we have increased our fixed rate bonds to a full exposure, within our long-term strategic limits. In the longer term we believe that there is a risk of further increasing inflation and accordingly we are monitoring our bond position closely. Furthermore, our largest category exposure is to inflation linked bonds, which offer some protection to investors if inflation rises. Credit exposure is limited as we see risk in the credit space, without seeing great protection from the credit spreads in the market. In equities we have invested in selected opportunities. We are cognizant of the risks facing the broad economy, and the pressure this could place on general corporate earnings. It may take several years to fully recover from the pandemic, while last July’s social unrest highlights the issues facing SA. Despite a large downward correction in property values, we maintain a modest position in this asset class until there is more evidence of where equilibrium market rentals may settle.

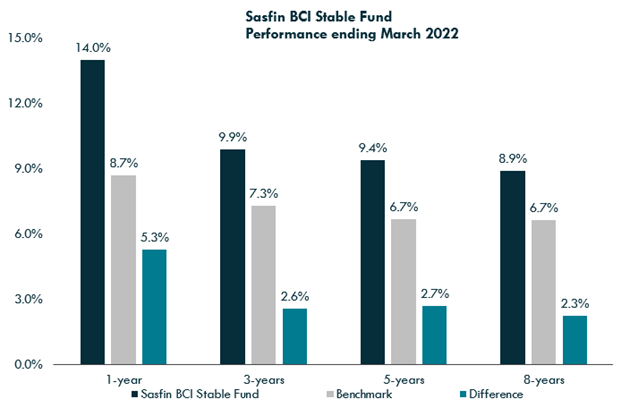

The Fund has enjoyed solid but stable returns to 31 March 2022, yielding 13.97% over the past year and 9.87% p.a. over the past 3 years, compared to the Fund’s benchmark of 8.69% and 7.29% p.a. respectively, which is represented by the average of the (ASISA) SA Multi-asset Low Equity category. The fund’s long-term target is CPI plus 4%. Performance was enhanced by some outstanding increases in prices of the shares selected for the portfolio, including MTN (+249%) PPC (+77%), Gold Fields (+66%), Sasol (+65%) and Mpact (+65%.) Going forward we will continue with our objectives of inflation beating returns, while controlling risk through both strategic asset allocation and individual security selection.

For more on the BCI Stable Fund click on the below video