Global Market Developments

At the start of 2022, market expectations were that the inflation that had permeated the economic environment would begin to ameliorate and that ultimately the US Fed’s initial assessment that it would be “transitory” would be the correct call. It only took a couple of weeks for that rosy assessment to dissipate rapidly as the twin disruptions of Russia’s war on Ukraine and China’s war on Covid introduced further skews to the inflation trajectory.

Russia’s war introduced a scenario of oil and gas supply disruptions into Western Europe, along the way then also stimulating an acceleration of a transition away from fossil fuel dependencies, in much the same way that the Covid pandemic accelerated the use of e-commerce and videoconferencing. China’s strict lockdowns across a swathe of industrial cities created further disruptions through a collapse in demand as well as further entanglements of the global supply chain.

So, with that background, markets quickly perceived that the Fed amongst other major central banks, was well behind the curve as far as heading off a more damaging and longer lasting phase of inflation. Indeed, many analysts already refer to it as a higher inflation “era”. Once it became clear that this was indeed the case, the key takeaway then was a potential loss of credibility for central banks, which would be an extremely damaging outcome. The result then is a Federal Reserve that recognises that it needs to increasingly move towards a front-loading of interest rates in the cycle, otherwise it risks the outcome of both a loss in credibility as well as an anchoring of inflation expectations at much higher levels.

The clear implication though was that the Fed would have to sacrifice the economy for the sake of avoiding those twin potential outcomes. This realisation spread like wildfire through markets once it became clear that the Russia-Ukraine war had permanently altered the European energy equation as well as the fact that it was likely to drag on for a much longer period than initially expected. The fear of a global recession has been steadily growing, reflected in equity market moves over Q2 2022. The S&P 500 for example declined 16.5% in the quarter. US bond yields, recognising that inflation risks were much more serious than previously thought, reacted with alacrity, starting the year at 1.5% and ending Q2 at 3.0% - a doubling of rates within 2 quarters. Note here that the Us 10-year bond has a duration of around 8.5 so a 1.5% move in yields translates to a capital loss of approximately 12.8%. For fixed income investors, that is an enormous move.

Bear in mind that it will still take some while and some serious footwork from the Fed before inflation will approach the pre-Covid levels of 2-2.5%. In the meantime, investing in US bonds trading at 3% whilst inflation is above 8% does not make for a good investment proposition. Having said that, the US bond market remains the deepest global financial market, and in a serious risk-off environment, the only market deep enough to provide a safe haven is the US bond market. So, risks abound and uncertainty prevails. Not much comfort here.

Local Market Developments

Surprisingly, the SA inflation trajectory has not followed the global path, but this may have much to do with the low growth trap that pervades our economic forecasts. Even a National Treasury that has experienced multiple quarters of revenue overruns relative to Budget expectations, finds itself unable to lift their own growth forecasts convincingly above 2%. There are signs though that the good times (well, for government revenues anyway) may not last.

As the market consensus shifts towards a heightened risk of global recession, the very commodities that buoyed our revenue overruns have fallen dramatically reflecting an impending collapse in demand. Were this to materialise, they would be faced with increasing pressure for social relief in the forms of subsidies, grants, higher wages, and the like, at precisely the time when the tailwinds begin to fade. Ratings agencies have noted this fragile situation, and South Africa can ill afford a significantly higher cost of capital for government.

Whilst local bond yields are, by historical measures in cheap territory, we caution that some of the fiscal and social risks are not fully priced in. They remain outlier risks but were they to be realised would play havoc with our economic health and trajectory. In particular, the experience of other Emerging Market peers, where inflation has indeed followed the global trends, is that social unrest and upheavals from an angry populace are not recipes for financial market stability.

The SARB also faces a difficult choice going forward – using the blunt tool of interest rates to curb inflation pressures that are not demand led. They too will likely follow a more front-loaded approach in the hope that the pain will be swift but temporary, and then allowing them to begin an equally swift down cycle to rescue the economy.

Looking Ahead

In our analysis, as highlighted earlier in the year, the key issues that markets will face during the next 12-18 months:

The importance of these issues cannot be emphasised enough – we are seeing essentially 3 overlapping shifts taking place simultaneously – a normal growth/inflation cycle, a macroeconomic paradigm shift in the sense of generation-high inflation rates, and the geopolitical paradigm shift. The net result is that there can be no return to “normal” in the sense of what the global economy looked like pre-Covid. In this respect then, we continue to believe that it requires a re-calibration of growth prospects and a concomitant reduction in forecasted corporate earnings. This adjustment is already taking place, but there are some market segments that will still face significant pain ahead. We also highlight that global recession will also bring forward a rising wave of defaults requiring additional credit risk premium in corporate bonds.

We see the following broad scenarios, which we typify as Alpha, Delta, and Omicron, in relation to the Covid variants. Alpha was the great unknown and caused the most concern; Delta was more of a known, but caused much more pain, whilst Omicron was the variant that caused the least disruption and the least pain.

The Alpha scenario: This is characterised by Stagflation – persistently high inflation, combatted by Central Banks raising rates rapidly to cool off demand-led inflation causing a shift to much lower growth rates, but they shy away from pushing the global economy into recession, so the result is a lingering, drawn out pain. Bond markets fear this scenario the most.

The Delta scenario: Characterised similarly by the initial persistent inflation, but Central Banks do not dodge the pain and trigger a short sharp global recession with commodity prices tumbling dramatically and inducing rapid falls in inflation rates, allowing rates to then fall rapidly again. This is the outcome that equity markets fear.

The Omicron scenario: This is the so-called “bullish” scenario, where contrary to market expectations, inflation does indeed fall back towards pre-Covid levels in a fairly consistent manner, allowing Central Banks to escape the scenario of having to continue front-loading rate hikes. Market take comfort from this and precipitate an enormous “relief” rally.

With this as the backdrop, and turning back to local outcomes, we believe that risks are rising for social unrest, and with an overlay of an ANC Elective Conference looming in December, the pockets of sunshine (and undisturbed electricity supply) may well be few and far between. This will require heightened risk premia to be built into asset prices.

Fixed Income Fund Dynamics

In the scenarios we paint above, we continue to believe that curtailing emotive responses to event-driven volatility will be crucial to the management of our funds going forward. This requires us to anticipate that, given the nature of the risks faced – in particular the inflation uncertainty – interest rate volatility is likely to be substantially higher than normal. This has ramifications for the strategies we use within our fixed income funds.

We will need to be nimble in our approach with the ability to change duration risks rapidly as volatility will produce opportunities for additional return or may conversely produce capital losses in short bursts. Thus, looking forward we foresee that focussing on the income component of the funds where some duration strategies are used, such as the Flexible Income Fund, will become extremely important.

Whilst our bond yields are cheap, they are likely to remain in cheap territory unless a sustained move downwards in US bond yields is seen, and, crucially, because the inflation outlook improves, and not as a result of a global search for safety.

We have in the most recent weakness, added to our duration positions, but remain cautious overall, having reduced the credit risk within the fund and thus retaining a fairly liquid fund giving us that ability to shift the strategic direction of the fund relatively easy. In addition, with the inflation uncertainties present, we have also increased our inflation-linked strategy as a risk hedge.

We are comfortable that the overall risk budget within the fund is well balanced, and we intend to maintain that approach going forward.

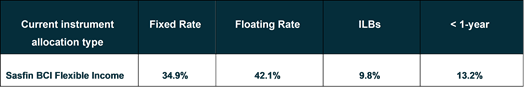

Positioning: Sasfin BCI Flexible Income Fund ending 30 June 2022

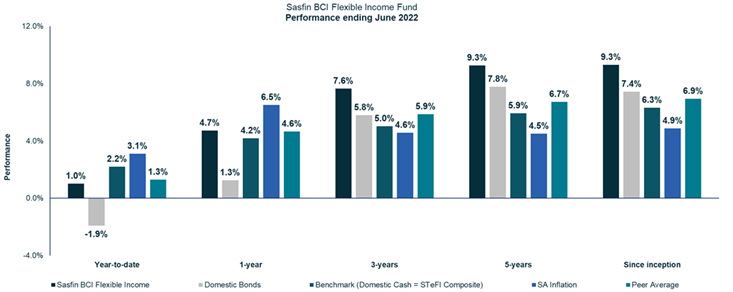

Performance: Sasfin BCI Flexible Income Fund ending 30 June 2022