Economic, Market and Regulatory Update – September 2023

The second half of 2023 started with investors concerned about a slowing global economy, a possible recession in the US and continued monetary policy tightening by central banks.

Watch the below video to learn more.

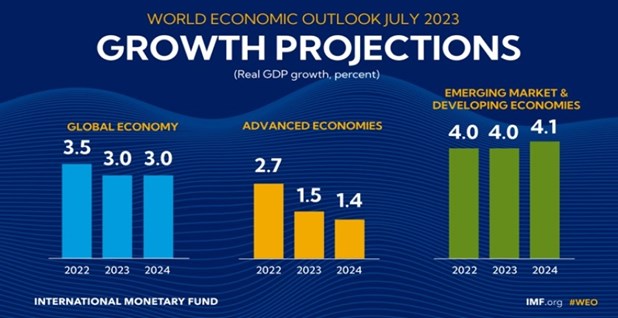

The second half of 2023 started with investors concerned about a slowing global economy, a possible recession in the US and continued monetary policy tightening by central banks. However, the International Monetary Fund upwardly adjusted its global economic growth forecast for 2023 to 3% in July from its previous forecast in April of 2.8% global growth. The IMF warned that the balance of risks to global growth remains tilted to the downside. Inflation could remain high and even rise if further shocks occur, including supply shortages in the oil market, an intensification of the war in Ukraine and extreme weather-related events.

The US economy appeared more resilient due to a strong jobs market and consumer spending and delivered an annualised GDP growth of 2.4% in Q2. However, the US government narrowly averted the threat of a federal government shutdown, as Congress approved a temporary funding bill to keep agencies open. These developments supported the downgrade by the Fitch Ratings agency of US government debt from AAA to AA-plus during August, as it raised concerns about a steady deterioration in governance standards in the US.

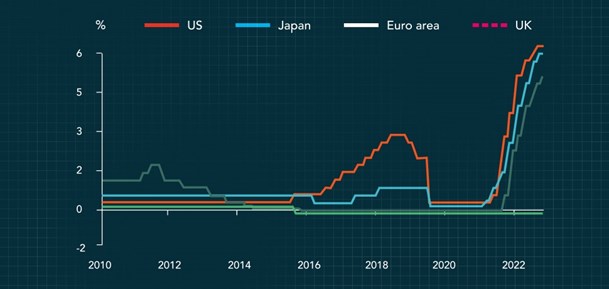

The US Federal Reserve Bank decided to pause its interest rate hikes at its monetary policy committee meetings in July and September on the back of slowing inflation. Jerome Powell, the governor of the US Federal Reserve Bank, did, however, indicate that depending on economic data, one more rate hike might be required towards the end of 2023 and that interest rates might have to be maintained at higher levels for longer. Central banks in the United Kingdom and Europe are also expected to be reaching the end of the current interest rate cycle. The European Central Bank raised rates by 0.25% during the September meeting, while the Bank of England left interest rates unchanged after 14 consecutive rate hikes.

Graph 1: Global Interest Rates

Source: Bloomberg & Alexander Forbes Investments

China continued to disappoint from an economic growth perspective despite announcing additional stimulus programs, as it struggles with a troubled real estate market and weaker-than-expected consumer spending.

Inflation rates in many countries have declined considerably but remain above the target rates of central banks in the developed world. These central banks still face the challenge of achieving their mandate of price stability by getting inflation under control while not causing the global economy too much pain as the cost of debt continues to rise. According to the IMF, global headline inflation is expected to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2 %in 2024.

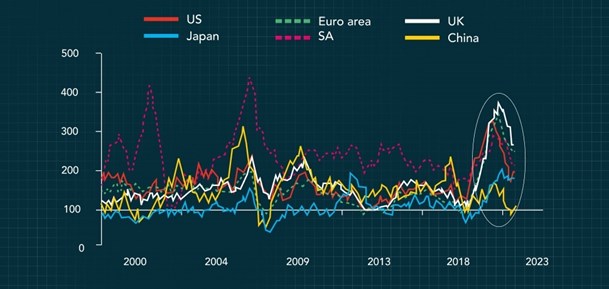

Graph 2: Global Inflation Rates

Source: Bloomberg & Alexander Forbes Investments

After a strong start during the first half of 2023, primarily driven by the Artificial Intelligence theme in the technology sector, global equity markets experienced some headwinds during the third quarter. Oil prices rose 30% from their lows in 2023 as Russia and Saudi Arabia cut supplies, while tighter monetary policy led to the rapidly rising cost of debt. This negatively impacted the global equity and bond markets, with yields in US Treasuries rising to multi-decade highs.

Graph 3: MSCI World Equity Index – 01 January to 30 September 2023 (US Dollars)

Source: Financial Times

During August and September, the global equity market, as measured by the MSCI World Index, gave back nearly half of the 15% gain recorded in the first half of 2023, to be up around 8% in US dollars for the year to 30 September. Bond market losses recorded during the quarter came as the 10-year Treasury yield, the benchmark for world borrowing costs, surged around 0.75% to just above 4.5%.

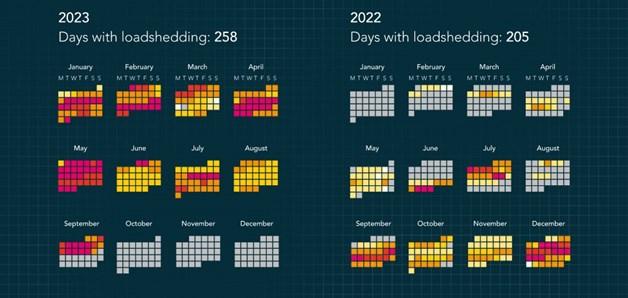

On the local front, the South African economy recorded another positive quarter-on-quarter growth of 0.6% during the second quarter of 2023. This is despite record levels of load shedding experienced during the first half of 2023.

Graph 4: South African GDP Growth – Quarter on Quarter

Source: Statistics SA

The impact of fluctuating energy supply continues to weigh on business confidence and the rand, resulting in the local economy performing far below its growth potential. However, greater involvement from the private sector, progress on transforming Eskom into separate business units and additional electricity generation capacity that will be coming online during the next year is expected to reduce the impact of load shedding.

Graph 5: Number of Days of loadshedding in 2022 and Year to Date in 2023

At the latest Monetary Policy Committee meeting in September, the SA Reserve Bank kept interest rates unchanged for the second consecutive meeting but warned that load-shedding alone would deduct 2% from economic growth this year. The SARB now believes the SA economy will grow by 0.7% in 2023, compared to its previous forecasts of 0.4% in July, and kept its growth forecasts for 2024 and 2025 unchanged at 1% and 1.1%, respectively.

CPI inflation declined to within the 3 to 6% target range of the South African Reserve Bank for the first time since April 2022. However, it rose from 4.7% in July to 4.8% in August as the positive base effects have now worked out of the annual inflation numbers. CPI Inflation is expected to move above the 5% level for the remainder of 2023, which will cause the South African Reserve Bank to be hawkish in its monetary policy approach by holding interest rates higher for longer. At the recent Monetary Policy Committee meeting, the South African Reserve Bank revised its headline inflation 2023 forecast slightly lower to 5.9%, while the core inflation forecast was revised meaningfully lower to 4.9%.

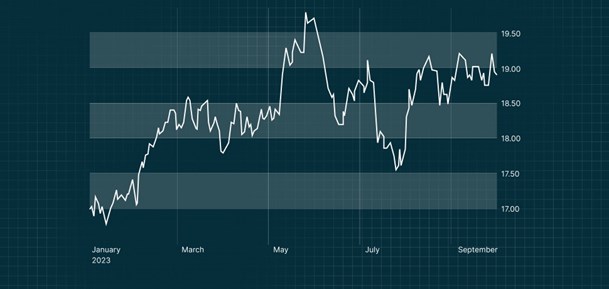

After getting caught in a perfect storm during the first half of 2023 to reach an all-time low of R19.91 to the US Dollar on 01 June, the rand was able to regain some ground to the end of September to close out the first quarter at around R/US$ 18.90. This left the rand weaker by around 10% against the US dollar for the year. The rand is expected to remain under pressure for the remainder of 2023 due to a strong US dollar, reduced investor risk appetite, slow local economic growth, and strained South African government finances.

Graph 6: Rand US/Dollar Exchange Rate - 01 January to 30 September 2023

Source: Financial Times

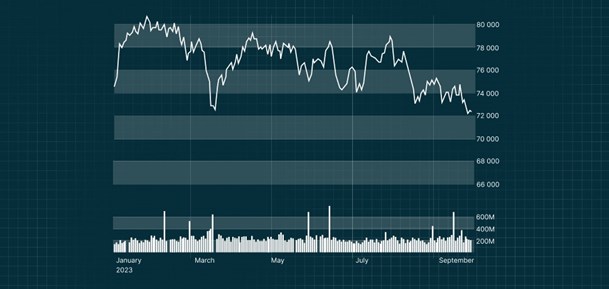

Since reaching a new record high and breaching the 80 000 level towards the end of January, the JSE has been on a continuous slide to reach its lowest levels for the year towards the end of September. This left the local equity market down 1% from where it started in January 2023. The sectors on the JSE continue to show a wide dispersion, with the Industrial index up 8% for the year to the end of September, while the Resources sector declined by 18% during the same period. As was predicted by many at the start of 2023, it has indeed been about sector selection and stock picking for investors in the local equity market.

Graph 7: FTSE/JSE All Share Index – 01 January to 30 September 2023

Source: Financial Times

During the third quarter, the local bond remained under pressure due to a weaker rand and negative foreign investor sentiment related to inflation political and fiscal risk concerns. This resulted in the bond market ending September flat relative to where it started in 2023 from a return perspective. Local property remains the worst-performing local asset class, declining by 6% for the year to the end of September.

From a regulatory perspective, more clarity has been gained around some aspects of the Two-Component retirement system that the National Treasury intends to implement on 01 March 2024. Some finer details still need to be finalised, including the size of the seeding element allowed from the vested comment. Sasfin Asset Consulting is investigating the potential impact on the default life stage investment strategies of our clients from a liquidity perspective. We will also be assisting our clients in informing and educating fund members on the implications for them once the new system is implemented.

Graph 8: The Two Component Retirement System

As we move into the final quarter of 2023, there seems to be more certainty around global and local economic growth expectations. The inflation trajectory will determine how soon central banks will consider possible interest rate cuts in 2024. Markets will discount the central bank views long before the actual decisions are made, and the language used by central bankers at the remaining monetary policy committee meetings for 2023 will be important in managing investor expectations.

A key focus in the next few weeks will be the Medium Term Budget that the Minister of Finance will deliver on 01 November. The market will focus on the growing fiscal challenge facing South Africa in the run-up to the national government elections in 2024.

While some areas of the global investment market look less expensive than a few months ago, attractive opportunities exist in the local equity and bond markets. The rand still has room to recover, barring a negative outcome from the Medium Term Budget and any further pressure on oil prices which could affect the inflation outlook and a risk-off environment caused by global developments.