In Douglas Adams’ second book in the five-book Hitchhiker’s Guide to the Galaxy “trilogy” he noted that “There is a theory which states that if ever anyone discovers exactly what the Universe is for and why it is here, it will instantly disappear and be replaced by something even more bizarre and inexplicable. There is another theory which states that this has already happened.” This classic snippet from comedic science fiction literature may resonate with many investors after the market events we’ve witnessed so far this year. In January, markets rose as investors thought they had a good understanding of the inflation and interest rate dynamics to come. That view entailed ongoing disinflation with an imminent peaking in interest rates and some monetary policy easing in the latter part of the year. That January clarity of understanding was instantly replaced at the very beginning of February with a view of sticky inflation coupled with higher interest rates that would be in place well into the next year. The markets balked at this new notion and gave up a measure of their January index gains in February. No sooner had investors adopted this new vision of the market universe than something more bizarre came to light. It turned out that the rapid rise in interest rates, designed to reduce inflation back to target levels, had other ramifications. Some poorly managed mid-size banks in the US found themselves in trouble as depositors, sniffing a bank collapse, rushed for their cash. The Federal Reserve Deposit Insurance Company was forced to quickly intercede to protect depositors as Silicon Valley Bank became the second largest bank failure in US banking history and Signature Bank became the third largest.

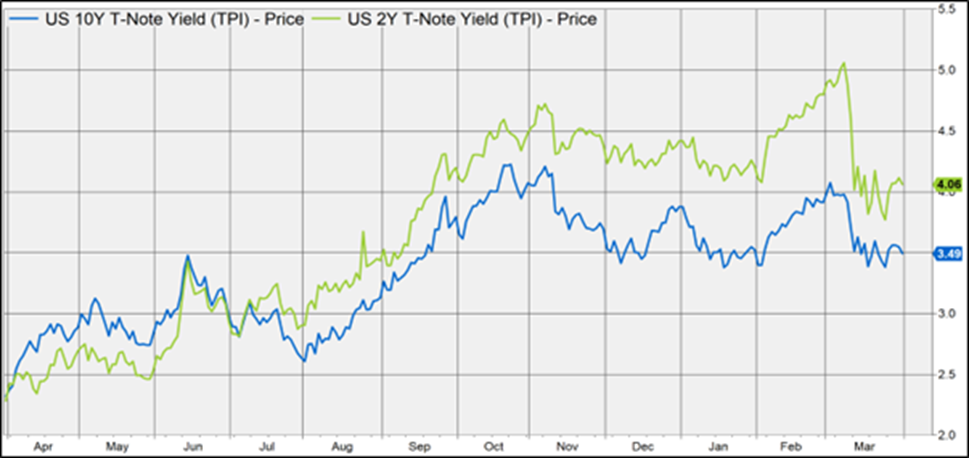

Silvergate Capital was another banking casualty (probably the first) with First Republic Bank also succumbing to the growing concern around mid-tier US banks. Questions were then asked of banks around the world and the beleaguered Credit Suisse was only saved from collapse by a weekend government-engineered deal that saw fellow Swiss bank UBS take over Credit Suisse. While equity markets adopted a risk-off environment in early March, US bond yields instantly changed tack. The one-year chart below highlights how the two-year treasury yield (in green) fell over 100 basis points in three trading days in early March as investors shifted their expectations back to a universe of peaking interest rates and easier monetary policy.

US two-year and 10-year bonds: Apr 2022 – Mar 2023 (daily)

As March progressed, investors became a little more comfortable with the banking sector after visible support by the fiscal authorities. There was also the belief that measures taken after the Global Financial Crisis in 2008/09 to improve the integrity of the global financial system would prevent a repetition of those events. The dilemma that central banks faced at their March meetings was whether to continue hiking interest rates in an environment of unacceptably high inflation or ease up on their tightening in the face of a potential banking crisis and possible credit crunch. As it turned out, the big central banks didn’t flinch. They stressed that the banking sector was safe and that inflation remained public enemy number one. The Federal Reserve hiked rates by 25 basis points, the European Central Bank hiked their policy rate by 50 basis points and the Bank of England moved the bank rate up by 25 basis points. Tighter policy was also seen in Australia, Switzerland, Mexico, Thailand, the Philippines and Colombia. The message that beating inflation was paramount and that managing inflation expectations was critical was brought home by our own South African Reserve Bank which hiked its main refinancing rate by a higher than expected 50 basis points. While the central banks continue to talk tough on inflation, the markets are calling their bluff for now on higher and higher-for-longer interest rates.

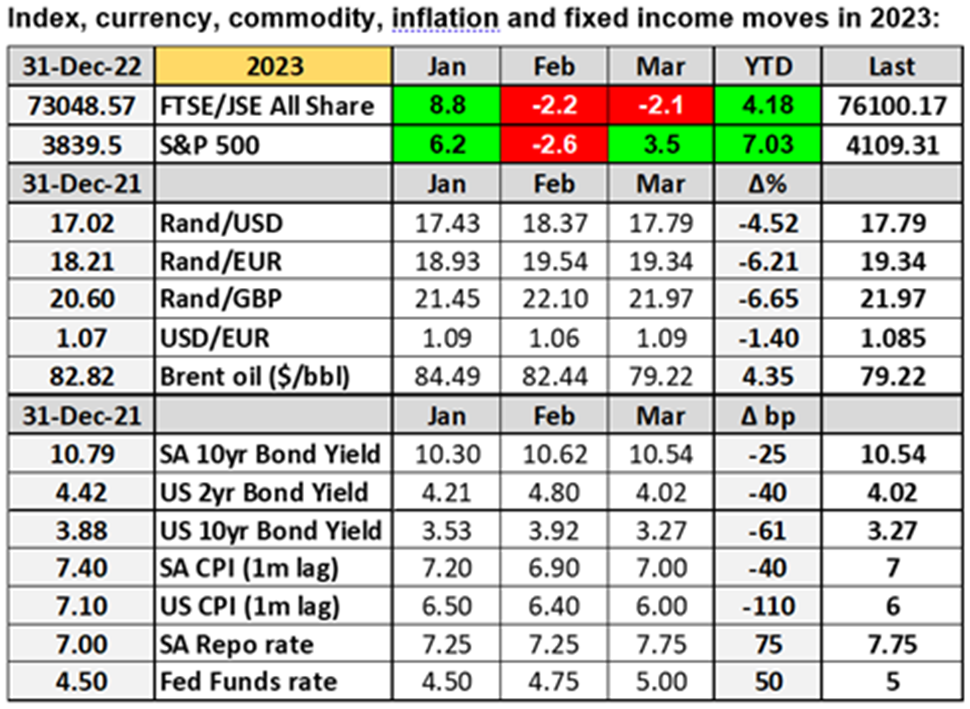

The S&P 500 index, a broad gauge of the US markets, traded up above 4,000 in the early going in March before quickly falling to a mid-month low of 3,855. Amidst some volatility, the index moved higher to end the month at 4,109 for a 3.5% gain (all-time high of 4,794 on 4 Jan 2022) – see table alongside. Local equities followed a similar path in March with the FTSE/JSE All Share index moving from a start of 77,733 to a mid-month low point of 72,528. The recovery over the remainder of the month, however, was not sufficient to regain all of the early lost ground and the index closed at 76,100 to be down 2.1% for March (all-time high of 80,791 on 27 Jan 2023). At the end of the first quarter of 2023, the S&P 500 was up 7.03% for the year-to-date while the FTSE/JSE All Share index was up 4.18% (-0.4% in US dollar terms).

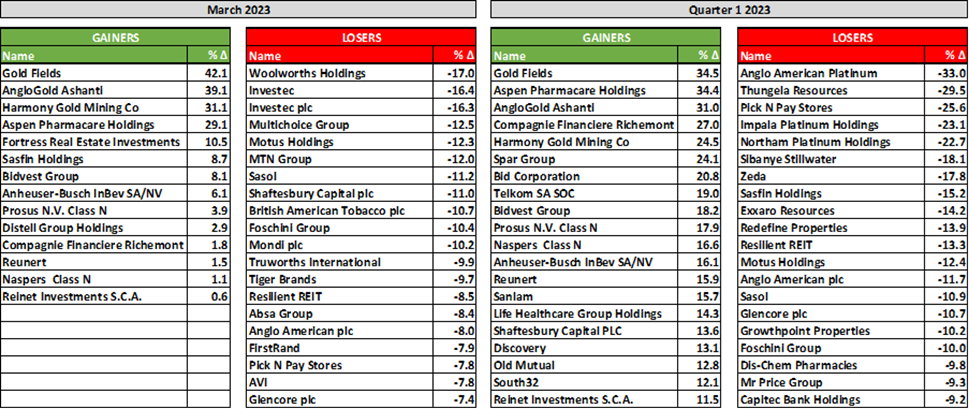

The turmoil in the equity and bond markets and the uncertainty around inflation gave gold a fillip in March. Spot gold started the month at $1,828/oz and flirted with $2,000 before closing out at $1,969/oz. Gold shares on the JSE had a field day in March (see table below) to leave them amongst the biggest market gainers over the quarter. Naspers and Prosus were modestly in the green for the month and the ongoing share buybacks and gains in Tencent helped lift them up to double digit gains in the quarter. Banks were under the cosh in March with the widespread global banking concerns but the market weakness was generally widespread in the month. While gold stocks were the big winners over the quarter, the big losers were in the platinum group metal (“PGM”) space and the broader mining complex. The rightmost column below reflects the losses year-to-date in some of the PGM-miners, Exxaro, Thungela, Sasol and the diversified miners Glencore and Anglo American – a symptom of slower growth in China and the rest of the world.

Winning and losing stocks on the JSE over March and Q1 2023 (price change only):

The markets continue their standoff with the central banks, however, taking the view that interest rates won’t go up much more and won’t need to stay elevated for long. The US equity market is thumbing its nose at the Federal Reserve and the market strength is an indication that investors believe that the first interest rate cut will be earlier than Jerome Powell and his Federal Open Market Committee colleagues are suggesting. Let’s all hope that if we do ever get to fully understand the path of inflation, interest rates, geopolitics and market movements, the investment world won’t instantly be replaced by something even more bizarre and inexplicable.